Cutting student debt rewards irresponsibility

This probably will make my former colleague Helen Ubinas mad at me.

But the Inquirer columnist has been mad at me, or my opinions, before.

Two things we share — our Bronx birthplace and our love of dogs. That’s about it.

We disagree that she is a liberal. I once called her that — not meant as an insult, because some of my best friends, you know — and she denied that’s how she rolls. Read her and decide for yourself.

Here I am going to quote her at length because she says something I strongly agree with:

“Don’t feel like doing your homework or your job or paying your bills or your taxes? Just don’t,” she wrote.

“Are bosses (or teachers or parents or significant others) on you to do something, or maybe stop doing something? Pffft, who’s gonna make you?

“For real, any time you’re called to take responsibility for whatever, whenever, don’t sweat it. Because who’s really held accountable for much of anything anymore? Not treasonous presidents, not seditious Republican lawmakers, not even a Capitol rioter who was given permission to vacation in Mexico while out on bail. (Insurrections can be so exhausting.)

“And lately, not our mayor.

“Last month it was revealed that Mayor Kenney would only sit for an interview with independent investigators looking into the city’s monumental mishandling of police protests if the questions were provided in advance and if followup questions were submitted in writing.

“And he declined — declined? — to appear at a hearing Friday to testify about his administration’s central role in the Philly Fighting COVID vaccination debacle.

“Not to say I told you so, but I told you so many times that unchecked accountability only leads to more unchecked accountability. Tolerating bad behavior begets more bad behavior.”

End quote. Full stop.

It’s like I have a twin! Personal accountability!

That didn’t sound very liberal. Maybe I was wrong about her.

But I’ll bet she’s 100% behind President Joe Biden’s idea to cut student debt loans by $10,000. Matter of fact, I am pretty sure she’d cut them even more, because she has written about how expensive college has become. As far back as 1996, when she was in Hartford, she shared a byline on that very subject.

I have written about the high cost of college myself, and I suggested how to avoid the crippling debt.

It’s really not hard. As with credit card debt, you avoid that by spending less.

If you can’t wangle a scholarship — academic or athletic — don’t go to a school you can’t afford.

In Pennsylvania, for instance, Penn’s annual tuition is $60,000. Penn State, however, charges $18,454 for instate students — two-thirds less than Penn. And has a much better football team.

If you pass up brand-name, “elite” schools in favor of state, or land grant schools, you will save a ton.

Do your first two years in a community college and you will save even more. It’s $8,345 a year for state residents at the Community College of Philadelphia.

But if you make the irresponsible choice to voluntarily go into more debt than you can repay, don’t expect me to bail you out.

Because when your student debt is “forgiven,” the money is still owed and someone else pays it back, one way or another.

So we are back to accountability, or personal responsibility, a favorite theme of mine.

The student debt payback scam idea was brought to the main stage by Sen. Elizabeth Warren, who was scrounging for student votes moved to action by concerns about students (such as those charged $65,000 a year at Harvard Law School, where she reportedly earns about $200,000 for teaching one course).

Warren started the pandering bidding at $50,000 debt forgiveness, a nice round number apparently pulled out of thin air. Needless to say, her campaign was very welcome on college campuses. It was also welcomed by the approximately 1 million people who default on student debt every year.

The $50,000 was never talked about as a handout — God forbid — to white elites, but that’s where the bulk of the money would go, angering previous students or parents who scrimped or worked two jobs to pay loans back.

It sounds nice to “forgive” a debt, but the message it sends undermines personal responsibility, and shifts the burden of the debt from the one who incurred it to the hapless taxpayer. As Helen said, why bother to do the right thing?

The “logic” behind the gift is that it would stimulate the economy.

You know what would stimulate the economy even more?

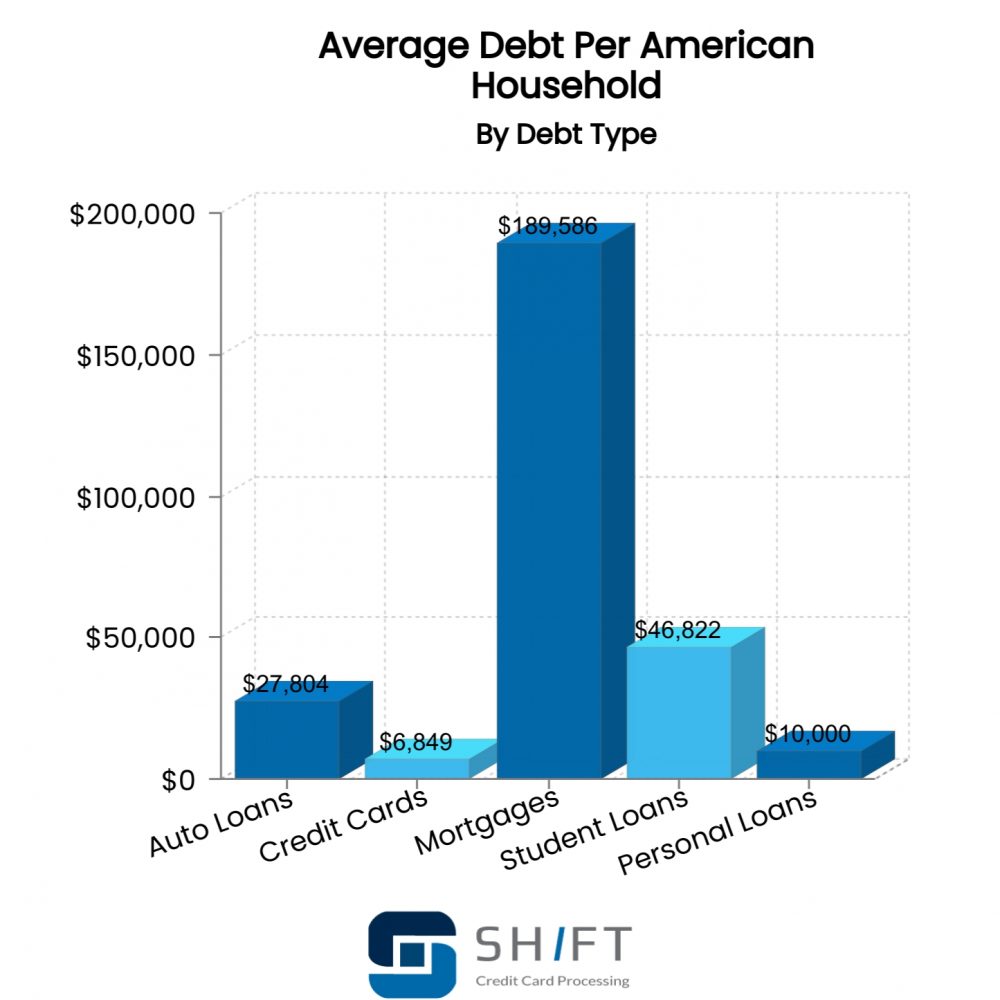

Pay off mortgages! That is the only pool of debt larger than student loans.

That would turn trillions loose, and that would go to people already contributing to the economy — taxpayers.

Why not cut them a break?

It’s not that I have no sympathy for the students. They should be able to renegotiate interest rates on their loans as homeowners do with their mortgage.

The theme here is personal responsibility.

If you have accepted a debt, pay it off. That’s what adults do. If they can’t, they suffer the consequences.

That’s just as much a learning experience as the college you took out the loan to attend.