College debt? Mostly it’s the rich

One reason I like Michael Smerconish’s Saturday morning CNN show is that I almost always learn something I didn’t know.

That’s something I try to provide on Stubykofsky.com — something you don’t know.

This past week, Smerconish did a segment on college debt forgiveness, which I oppose.

William Shakespeare cautioned against being neither a borrower nor lender, but that was before mortgages, car loans, and college.

Smerconish’s guest was Beth Akers, an economist who also opposes it, but for different reasons. https://www.educationnext.org/fallacy-of-forgiveness-if-feds-wipe-out-student-debt-who-will-benefit-forum/

Smerconish’s phone-in poll that day asked whether President Joe Biden should make good on his campaign promise to wipe away at least $10,000 of debt from all students who owe money.

That would be across the board, irrespective of need.

Since the main part of CNN’s (small) audience is liberal, I was not surprised that most voted yes, but I was surprised the margin was so small — 52-48.

I have opposed the forgiveness in my columns, such as this one, https://stubykofsky.com/cutting-student-debt-rewards-irresponsibility/ where I argue that forgiving debt breeds irresponsibility, and debt can be avoided by choosing a less expensive college.

One example I gave: “In Pennsylvania, for instance, Penn’s annual tuition is $60,000. Penn State, however, charges $18,454 for instate students — two-thirds less than Penn. And has a much better football team.”

Then, for good measure:

“But if you make the irresponsible choice to voluntarily go into more debt than you can repay, don’t expect me to bail you out.

“Because when your student debt is ‘forgiven,’ the money is still owed and someone else pays it back, one way or another.”

The “someone else” often is a taxpayer who did not go to college, because only about 40% of Americans have college degrees.

Those arguments I would call moral, or fairness, arguments.

Akers dug into the numbers and came up with an entirely different argument against debt forgiveness: It favors rich people.

What?

It is not a perfect fit, but here is what she told Smerconish:

“Sixty percent of student debt is held by the top 40% of the income distribution. This is not a poverty alleviation measure. This is not even a targeted subsidy to people who are struggling economically. This is just a flat-out giveaway to people who they need in the upcoming midterm elections.”

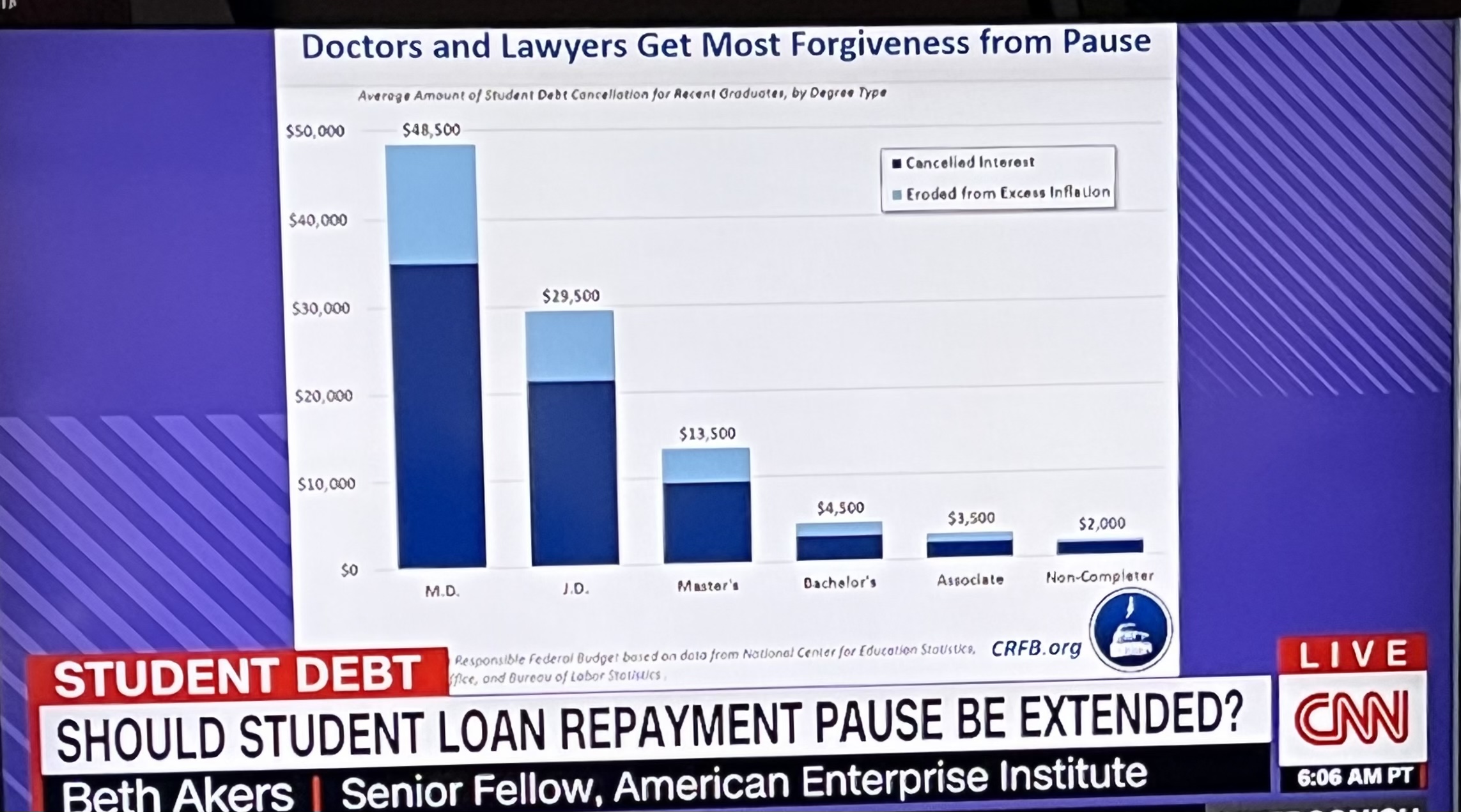

She brought along this chart that shows who gets the most forgiveness from the current pause.

The Wall Street Journal estimates the current debt pause has cost taxpayers $100 billion already.

Most of the people in debt owe small amounts, Akers said, while the larger debts are owed by those who will make more money in their life.

And, she added, there is already in place a forgiveness program that allows people “who are struggling to make reduced monthly payments that can even be reduced to zero if they have very low income. So that’s missing from the conversation because it is not politically convenient.”

I didn’t know that? Did you?

Any way you look at it, the “forgiveness” amounts to that Dire Straits tune, “Money for Nothing.”