One reason I like Michael Smerconish’s Saturday morning CNN show is that I almost always learn something I didn’t know.

That’s something I try to provide on Stubykofsky.com — something you don’t know.

This past week, Smerconish did a segment on college debt forgiveness, which I oppose.

William Shakespeare cautioned against being neither a borrower nor lender, but that was before mortgages, car loans, and college.

Smerconish’s guest was Beth Akers, an economist who also opposes it, but for different reasons. https://www.educationnext.org/fallacy-of-forgiveness-if-feds-wipe-out-student-debt-who-will-benefit-forum/

Smerconish’s phone-in poll that day asked whether President Joe Biden should make good on his campaign promise to wipe away at least $10,000 of debt from all students who owe money.

That would be across the board, irrespective of need.

Since the main part of CNN’s (small) audience is liberal, I was not surprised that most voted yes, but I was surprised the margin was so small — 52-48.

I have opposed the forgiveness in my columns, such as this one, https://stubykofsky.com/cutting-student-debt-rewards-irresponsibility/ where I argue that forgiving debt breeds irresponsibility, and debt can be avoided by choosing a less expensive college.

One example I gave: “In Pennsylvania, for instance, Penn’s annual tuition is $60,000. Penn State, however, charges $18,454 for instate students — two-thirds less than Penn. And has a much better football team.”

Then, for good measure:

“But if you make the irresponsible choice to voluntarily go into more debt than you can repay, don’t expect me to bail you out.

“Because when your student debt is ‘forgiven,’ the money is still owed and someone else pays it back, one way or another.”

The “someone else” often is a taxpayer who did not go to college, because only about 40% of Americans have college degrees.

Those arguments I would call moral, or fairness, arguments.

Akers dug into the numbers and came up with an entirely different argument against debt forgiveness: It favors rich people.

What?

It is not a perfect fit, but here is what she told Smerconish:

“Sixty percent of student debt is held by the top 40% of the income distribution. This is not a poverty alleviation measure. This is not even a targeted subsidy to people who are struggling economically. This is just a flat-out giveaway to people who they need in the upcoming midterm elections.”

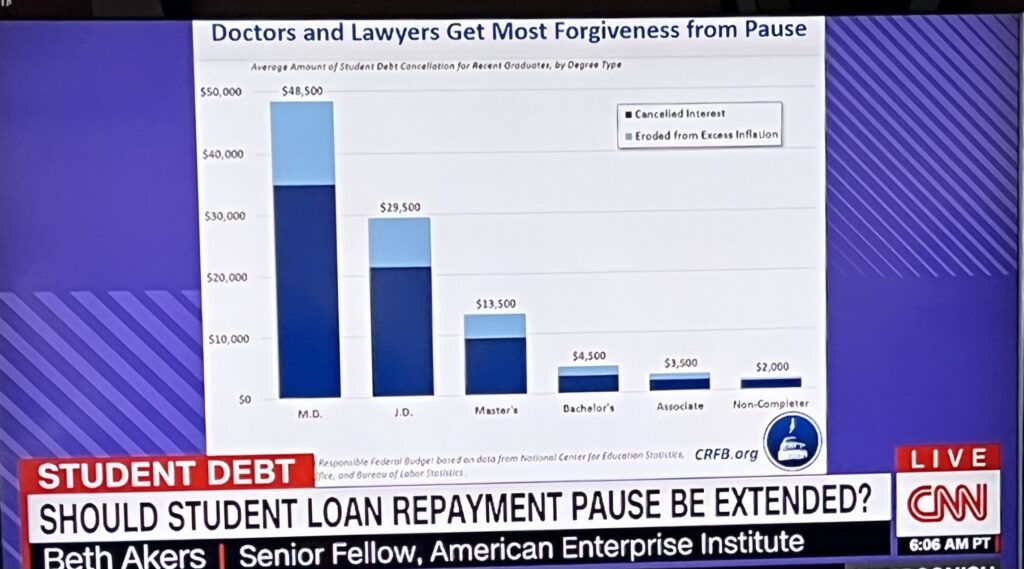

She brought along this chart that shows who gets the most forgiveness from the current pause.

The Wall Street Journal estimates the current debt pause has cost taxpayers $100 billion already.

Most of the people in debt owe small amounts, Akers said, while the larger debts are owed by those who will make more money in their life.

And, she added, there is already in place a forgiveness program that allows people “who are struggling to make reduced monthly payments that can even be reduced to zero if they have very low income. So that’s missing from the conversation because it is not politically convenient.”

I didn’t know that? Did you?

Any way you look at it, the “forgiveness” amounts to that Dire Straits tune, “Money for Nothing.”

Mr. B.,

There were some unscrupulous lenders that duped student borrowers into flex loans whose end result added >40% to the initial student loan. Harrisburg knew these lenders were peddling deceptively usurious student loan conditions and did zero to stop the crime.

This is, basically, a crime. Excessive interest rates should be negotiates, like refinancing a mortgage.

HAPPY TUESDAY !!!

pallie,

Right again. Those that got – keep. Nothing has changed in respect to college funding. When you have connections, things go your way. If you are financially secure, you are smart enough to seek out the best direction to send your money. All of my grandchildren are college educated . In most cases, their jobs demand higher degrees. Professional ( seal ) Engineer also requires more education. The difference here, is that the chosen fields of employment justify the added expense of higher education.

BTW. Smerconish always has been a good study. His family is well placed in Bucks County.

Tony

We watched this and were amazed that even after all that was presented by Beth Akers that people still wanted to forgive student debt. Good grief. You take out a loan, you pay the damn thing back. At least that is how it worked for Brian and me and our kids. Must be something wrong with us.

That’s because progressives are motivated by emotion, not reality.

Stu–How would you deal with this situation? Been paying on these loans for 34 years of my life. I am 63. Life happens and financial loss incurred to do a divorce, two job losses and 2 bouts with cancer. The personal financial loss from these life events cause the compound interest to rack up. Now, paying only on the interest and no end in sight. How is that emotional?

First, I am sorry for your situation. To answer your question, I would have to know how much you borrowed, what your major was, and your lifetime earnings.

As noted, the government already has forgiveness programs for low-income people. Have you explored them?

Why not forgive auto-loan debt? Or home-repair debt? Or any large debt?

I suggested my mortgage. Over decades of tax paying, I have made great contributions to this country. What have the kids done?

“Children: the gift that keeps on taking.”

I don’t agree with erasing college debt. What needs to be done is provide prospective student borrowers with counseling! At least after counseling they can make an informed whether or decision whether to borrow or not!

There can be unintended consequences for policies even with best intentions that are often times conveniently ignored. I stopped reading the Philadelphia Inquirer about two years ago but prior to that occasionally commented on their op-ed columns. One such comment was “blocked” because I used the expression “eff you” (verbatim) to describe the phenomena of unintended consequences as it related to a certain well-intentioned progressive policy being advanced. And you addressed said phenomena in this piece.

While feel-good legislation such as debt relief/retirement might sound good to some, what message is being sent to those who have diligently paid off their obligations? “Eff you,” that’s what it says. So, for those who have previously retired their own debts somehow, you will be rewarded for your thoughtful diligence by taking on someone else’s obligations. In other words, “eff you” again!

A similar argument can be made for other well-intended policies like open borders (and the list goes on). In bypassing the legal route, the implied message to our fellow Americans who endured the rigors on the path to legal citizenship is “eff you.”

In both cases it sure ain’t nice and it sure ain’t right.