Biden sticks with crazy tax promise

Stevie Wonder sang “Signed, Sealed, Delivered” about his love, while President Joe Biden might have been humming the tune Tuesday as he signed his massive climate, health, and tax bill into law.

He could legitimately claim credit for getting the deal done. Republicans could claim credit for reducing the bloated budget by about two-thirds. I have never seen a government budget that did not contain some pork.

The bill was a compromise, which is how things get done in Washington, when they get done at all.

After reading through various descriptions of the bill, from the Left and Right, it seems the climate cowboys got a lot. Major corporations that make moves to reduce their carbon footprint, a good thing, will get tax breaks, as will you if you want to buy an electric car, or install solar panels. (I can’t afford an electric car and solar panels on my high high-rise condo is a nonstarter, but what the hell.)

As a senior, I stand to save a little on pharmaceutical costs, even though I now have supplemental insurance to reduce costs. Will my bills be further reduced? I don’t know and fortunately I am solvent enough so that it won’t break me. The cap on insulin costs is a wonderful idea.

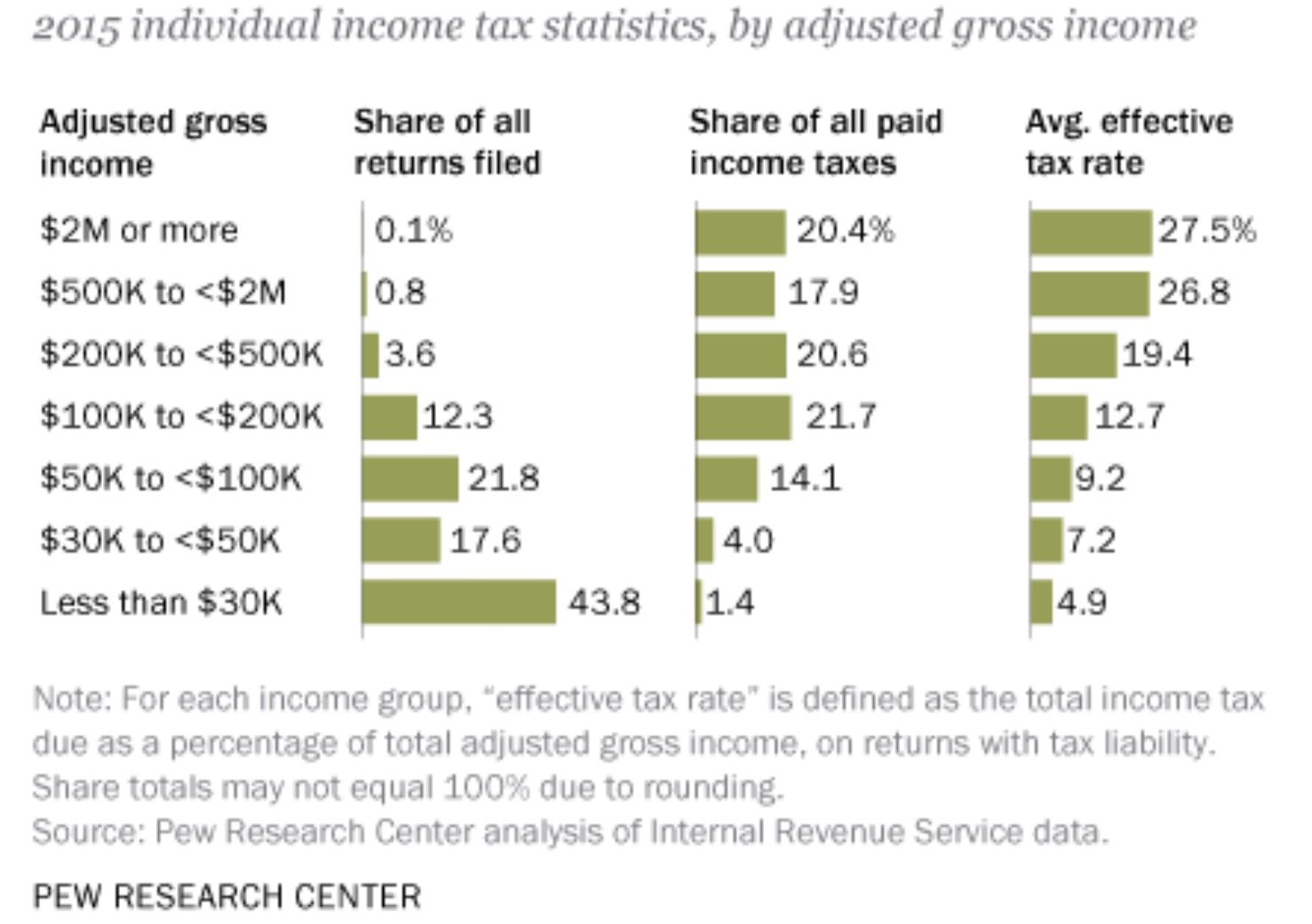

Savings, pension, Social Security, and 401k have provided my cushion. I suspect most people reading this are in my “tax bracket” — meaning under $400,000 a year. (If you are above that, congratulations, and may I suggest advertising on stubykofsky.com?) 😄

So here is the point: Since his candidacy, Biden has insisted that anyone making less than $400,000 a year would not pay an additional penny in taxes to pay for his programs.

Republicans fervently insist the trillions to fund all this spending would have to reach into the pockets of the middle class.

Nah, says The New York Times’ Paul Krugman, hardly an objective source.

The conservative Washington Examiner says polling shows the middle class doesn’t believe Biden’s claims.

Do I?

Do I believe the Inflation Reduction Act will actually reduce inflation?

Well, not in time for the November election, anyway.

Just as Biden is promising to redline under-400G earners from government scrutiny, he has ordered up an additional 87,000 IRS agents.

People earning up to $400,000 amount to roughly 97% of all taxpayers.

Why would Biden want to exclude them from examinarion? Does Biden imagine that within 97% of the population there are no tax cheats?

Is it believable that 87,000 agents are needed to pour over the returns of the top 3%?

73.2% of Americans report incomes of less than $100,000. Should they get a pass?

A long time ago, my accountant told me the IRS is computerized, and the computers have a framework of what your return should be, based on your income and other factors, such as dependents.

I told my accountant I wanted to pay every penny actually owed, that I did not want to cheat, but I would take every legitimate deduction. (A quick aside: I prefer the 20% flat tax. Much simpler, and harder to cheat.)

On occasion, I would have an unusual expense, and my accountant would tell me that it “would trip the computer,” even though it was totally legitimate.

It might result in an audit.

“Knock it down to get by scrutiny,” I told him. Going through the agony of an audit was just not worth saving a few bucks.

Do I feel threatened by the 87,000 additional agents? Republicans say I should be.

I do not because my return will be filled out honestly and accurately. IRS can’t make a case with no evidence and numbers don’t lie.

For the record, I have never been audited. We will see if my streak remains intact.