Stevie Wonder sang “Signed, Sealed, Delivered” about his love, while President Joe Biden might have been humming the tune Tuesday as he signed his massive climate, health, and tax bill into law.

He could legitimately claim credit for getting the deal done. Republicans could claim credit for reducing the bloated budget by about two-thirds. I have never seen a government budget that did not contain some pork.

The bill was a compromise, which is how things get done in Washington, when they get done at all.

After reading through various descriptions of the bill, from the Left and Right, it seems the climate cowboys got a lot. Major corporations that make moves to reduce their carbon footprint, a good thing, will get tax breaks, as will you if you want to buy an electric car, or install solar panels. (I can’t afford an electric car and solar panels on my high high-rise condo is a nonstarter, but what the hell.)

As a senior, I stand to save a little on pharmaceutical costs, even though I now have supplemental insurance to reduce costs. Will my bills be further reduced? I don’t know and fortunately I am solvent enough so that it won’t break me. The cap on insulin costs is a wonderful idea.

Savings, pension, Social Security, and 401k have provided my cushion. I suspect most people reading this are in my “tax bracket” — meaning under $400,000 a year. (If you are above that, congratulations, and may I suggest advertising on stubykofsky.com?) 😄

So here is the point: Since his candidacy, Biden has insisted that anyone making less than $400,000 a year would not pay an additional penny in taxes to pay for his programs.

Republicans fervently insist the trillions to fund all this spending would have to reach into the pockets of the middle class.

Nah, says The New York Times’ Paul Krugman, hardly an objective source.

The conservative Washington Examiner says polling shows the middle class doesn’t believe Biden’s claims.

Do I?

Do I believe the Inflation Reduction Act will actually reduce inflation?

Well, not in time for the November election, anyway.

Just as Biden is promising to redline under-400G earners from government scrutiny, he has ordered up an additional 87,000 IRS agents.

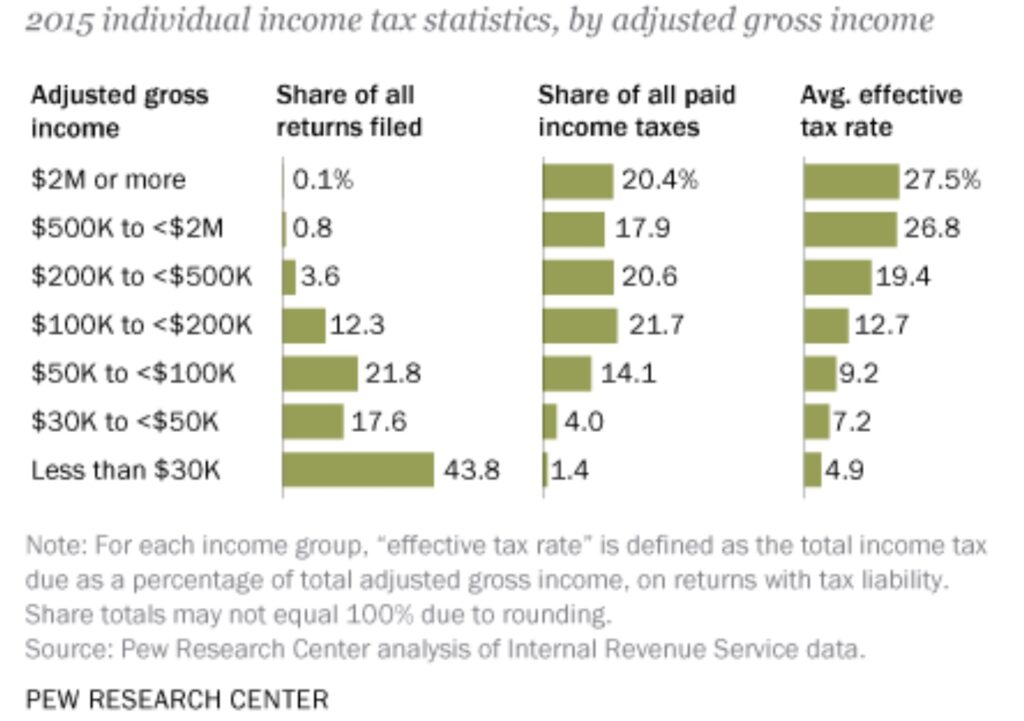

People earning up to $400,000 amount to roughly 97% of all taxpayers.

Why would Biden want to exclude them from examinarion? Does Biden imagine that within 97% of the population there are no tax cheats?

Is it believable that 87,000 agents are needed to pour over the returns of the top 3%?

73.2% of Americans report incomes of less than $100,000. Should they get a pass?

A long time ago, my accountant told me the IRS is computerized, and the computers have a framework of what your return should be, based on your income and other factors, such as dependents.

I told my accountant I wanted to pay every penny actually owed, that I did not want to cheat, but I would take every legitimate deduction. (A quick aside: I prefer the 20% flat tax. Much simpler, and harder to cheat.)

On occasion, I would have an unusual expense, and my accountant would tell me that it “would trip the computer,” even though it was totally legitimate.

It might result in an audit.

“Knock it down to get by scrutiny,” I told him. Going through the agony of an audit was just not worth saving a few bucks.

Do I feel threatened by the 87,000 additional agents? Republicans say I should be.

I do not because my return will be filled out honestly and accurately. IRS can’t make a case with no evidence and numbers don’t lie.

For the record, I have never been audited. We will see if my streak remains intact.

Stu, you make a good point. My 80 year old barber, for example, only takes cash. He boasted to me that one of his customers was an IRS agent who advised him on what triggered an audit so he can avoud being audited.

Now, he’s not a big fish, but there are millions of people in the cash economy who don’t report their income. The rest of us have to pick up the tab. Cry audit, and let loose the dogs of the IRS.

👍

I haven’t had a chance to pore through the micro and macro economic ramifications of this bill, so I will sit out that until I have a better handle on the facts and theories. But I would caution about the cap on insulin. While emotionally I am all for affordable insulin, intellectually I am worried about the unintended consequences of this cap. Insulin is an old drug and in my day was made from pig insulin. It was cheap. Since then a human (Humulin) insulin has been developed from human cells. Not so cheap. This is what most people take and it has been a game changer. Unfortunately, we have seen what happens with caps and things like windfall profit taxes. Manufacturers stop producing what they see will not be profitable. Oil is but one example. I hope that the powers-that-be have taken that into their calculus, but I am not hopeful.

I am always wary of mandates, but stories of insulin — needed for life — going up 500% makes me feel good about the cap.

HAPPY WEDNESDAY !!!

pallie,

Good job ! Not just in writing a necessary blog with common sense, but getting Andrew and Wanda on the positives. Make that three. I don’t agree with you graft for starters. Adjusted gross is the key for everyone. The very wealthy usually pay their share, but it’s after they legally hide every dime that they can. This is why people with money have money. They hire the professionals that will save them the bucks.

I only did a quick summary of the IRA. True, there are a few wins for the working class. They will quickly disappear as the dollar bill circulates through al of the hands of those being taxed. Nothing changes there. As we all know. A business man is in business to make money. He stays in business because he produces a quality product at a reasonable price. We go food shopping and we can see how prices have risen. Some products are extremely expensive compared to those that only went up a few cents.

As for tax returns. You are both smart and cautious. True. The RS has been computerized for years. The program will pick out irregularities in an individual account. Stay within the guidelines that are given and you have a better chance of hitting the lottery than that of being audited.

Tony

There is no need for 87,000 new IRS agents. The Fed and US government could set a date such as January 1, 2024 where our economy becomes cashless and coin less. Many businesses refuse debit & credit cards for payment of services and products. These business owners tell the IRS what there earned income is. The IRS takes their word for it. A true accounting of earned income can be determined easily through a cashless system. I know this idea is controversial but it’s time is coming. Let’s give people a couple of years to turn in their cash.

Been audited twice. Won both audits. (The ONLY bureau in the fed that assumes you guilty until you prove your innocence.)

Only the Democrats can, with a straight face, tell us that by increasing spending they will lower inflation and save us money. As Churchill said (and I paraphrase) ‘Spending money to save money is like standing in a bucket and trying to life yourself with the bucket’s handle.’

Finally, for all of those morons lusting after an electric car, where do you think the electricity comes from to charge those car batteries? (Hint: think oil and coal and natural gas.) Not to mention the cost of the 500-mile long extension cord. (That’s a joke, for you Biden lovers.)

😉😉😉😉

Stu, Why do you not you ever talk about trumps failed administration? I guess you republicans are so full of hate you forget about Biden trying to bring us peace and prosperity. And are just worried about petty bullshit.

😉😉😉😉

My sarcasm detector in pinging like mad. 😏

I was hoping it would Stu. I wonder if someone else, (I think you know who), will get it?

Trump didn’t have a failed administration

HAPPY THURSDAY !!!

pallie,

How’s things ? Not for nutt’n’, but my sister just had her other hip replaced Tuesday. She’s up and about. As I said before, our dad passed on to us high pain tolerance and quick recovery time. Our mom, being Italian, gave us all thick skulls ! Most of the folks on your blog will appreciate that little tidbit.

On the subject. Most people on these social media networks like to keep it casual. They also don’t like to do any subject review. Maybe because they already know it all. Iam in the former. I try to make myself knowledgeable on the subject in the conversation. Like you, I have my own opinions ut I will ‘discuss’ the topic with anyone that wants to talk – not mock. Gee, who can that be ?

The IRA was passed along party lines. No surprise there except for four republicans giving a ‘not voting’, which is the same as a Yay vote. The summary clearly indicates the bill consistencies. It’s scary ! I’ll finish reading the bill in its entirety today, I hope. In short, it is not anything that the middle class wants. The few (5) wins are only partials. Reduced medical for one. We don’t get what’s promised on the airwaves. Unless, ‘getting screwed’ is what you are looking for. All of these so called reductions to us will be absorbed by the manufacturers. NOT ! As always, cost is passed onto the consumer. The swamp knows that, just as much as we know and understand capitalism.

Hopefully, the impasse will end this November.

Tony

greetings comrades-we are pleased to see you are all wearing your masks.We would like to commend you for alerting us of this pernicious barber who has been cheating the people and of this Anthony pallie enemy who is clearly guilty of wrong think.We will deal with him along with that Oregon diner waitress clearly underreporting her tips.The gulag has plenty of room-nothing to fear.

That pernicious “80 year-old” barber! Better to deal with him first, contingent to this deplorable criminal dying on us! Then, ruin that evil, deplorable waitress. We all know that because of these sad individuals, our southern border is leaking INTO our country like a busted sewage pipe, spreading stinking, fetid “citizens” into our once civilized society.

And they are all paid cash and they sure ain’t payin taxes

Of course, the 15% tax on corporations will be passed on to the consumers. Instead of lowering inflation, Joe “I’m Not All Here” Biden has assured inflation will continue unabated. Corporations ALWAYS pass tax increases through to the customer. Duh, Joe!

False info. The IRS is not adding 87,000 agents, you fool. They’re adding staff: clerks, auditors, managers. The IRS does have a handful of ‘agents’ who are federal agents. Why is it, whenever the IRS staff is cut, income tax evasion goes up? Answer me that, trumpybear!

BTW, most merchants DO take credit & debit cards. And it’s the VISA/Mastercard duopoly who is ripping off merchants with all the high fees, not the IRS. Thanks to COVID, people are using their cards far more. Cash is being used less & less.