Obamacare

What’s behind Obamacare congressional wrestling

Congress wraps up its year in a few days and if Obamacare is not fixed, premiums are expected to skyrocket after January 1.

Cartoon

Kelly’s Heroes was a pretty OK war movie.

Zohran Mamdani

The Zohran says, correctly, ICE can’t enter a private space, such as a home, without your permission, or without a judicial warrant. Suspects do not have to open their doors.

Kennedy Center Honors

If he doesn’t outdraw Jimmy Kimmel, he said he shouldn’t be President

President Donald J. Trump

U.S. law does not condone guilt by association or collective punishment.

Culture

From turkey to cranberries to stuffing to corn to pumpkin pie, everything will cost more this year.

Catherine Lucey

On more than one occasion, when writing about a good-looking male celebrity, she lasciviously confessed how much she would like to “do” him.

Bike lanes

Bochetto describes what happened as "legislation by ambush” that “is not only morally despicable, but illegal as well.”

John Fetterman

If his dress is weird, so are many of his ideas, and his personality.

Due process

I support law enforcement, such as ICE, but I have criticized the agency when it does not play by the rules, such as respecting due process.

Reality determines my political positions, not vice versa

The city broke its word when it passed the idiotic no-stopping ordinance.

Does this mean Trump knew of sex trafficking? It does not.

Its first draft was complete, factual, and nonpartisan, giving arguments from both sides of the aisle, and the differing sides within the Democratic caucus, which is a fancy name for a street gang.

If hitting an officer with a sandwich is OK, how about a paper cup? How about an empty plastic water bottle? How about a full water bottle?

“A fool and his money are soon elected.”

The tighter a Republican candidate is to President Donald J. Trump, the worse they will do in a moderate state.

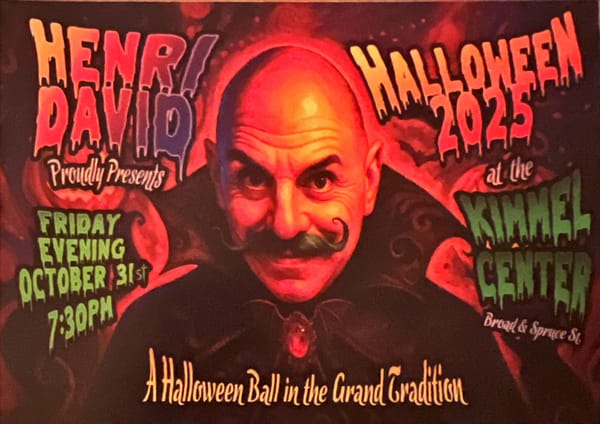

“Don’t come as you are, come as you want to be.”

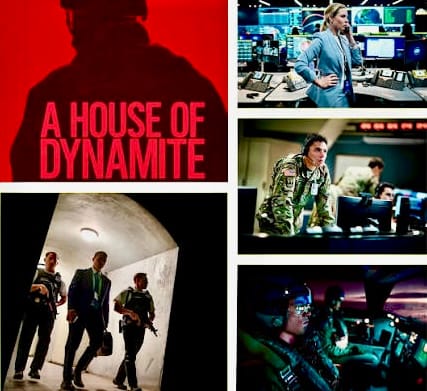

By genre, this is ticking-bomb stuff. In 18 minutes something catastrophic will happen, can we dodge the bullet, so to speak?

American politics today can seem to be dominated by extremes. President Trump is carrying out far-right policies, while some of the country’s highest-profile Democrats identify as democratic socialists. Moderation sometimes feels outdated. It is not.

In more than 40 paragraphs, several pro-trans people are quoted, while only one mention of opposition to “rights” of trans people

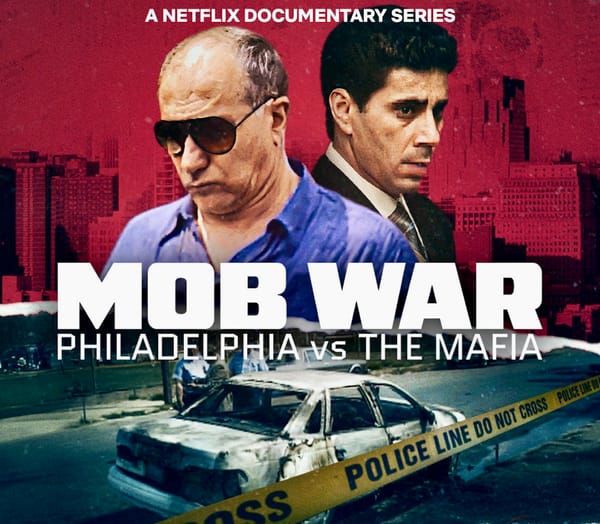

I covered the mob from the edges, but I had a couple of advantages

The restaurant’s logo is a rooster, for some reason. Maybe it’s the cock in kocktails.